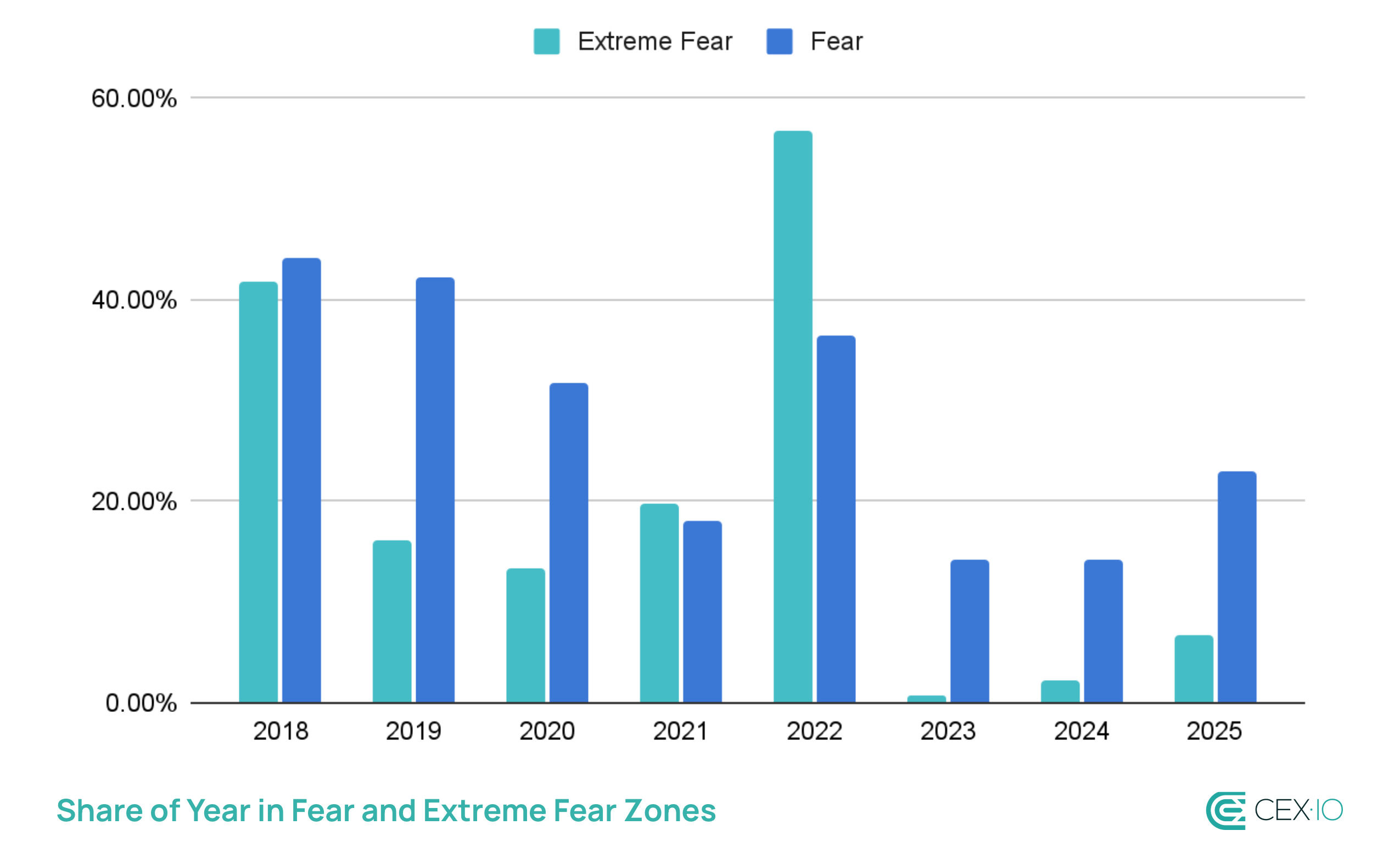

- 2025 became crypto’s most emotional year since 2021, with most major swings in the Fear and Greed Index pushing crypto into the fear territory.

- In 2025, the crypto market has become more fearful than the stock market, while the opposite trend has been in place for a while.

- 70% of survey respondents stated that the crypto market might have already reached its cycle peak.

The crypto market just lived through its bleakest month of 2025. Over the past 30 days, the Fear and Greed Index averaged 32, spending 27 of those days in the fear or extreme fear zones. This also makes it the worst sentiment stretch the market has seen since 2022.

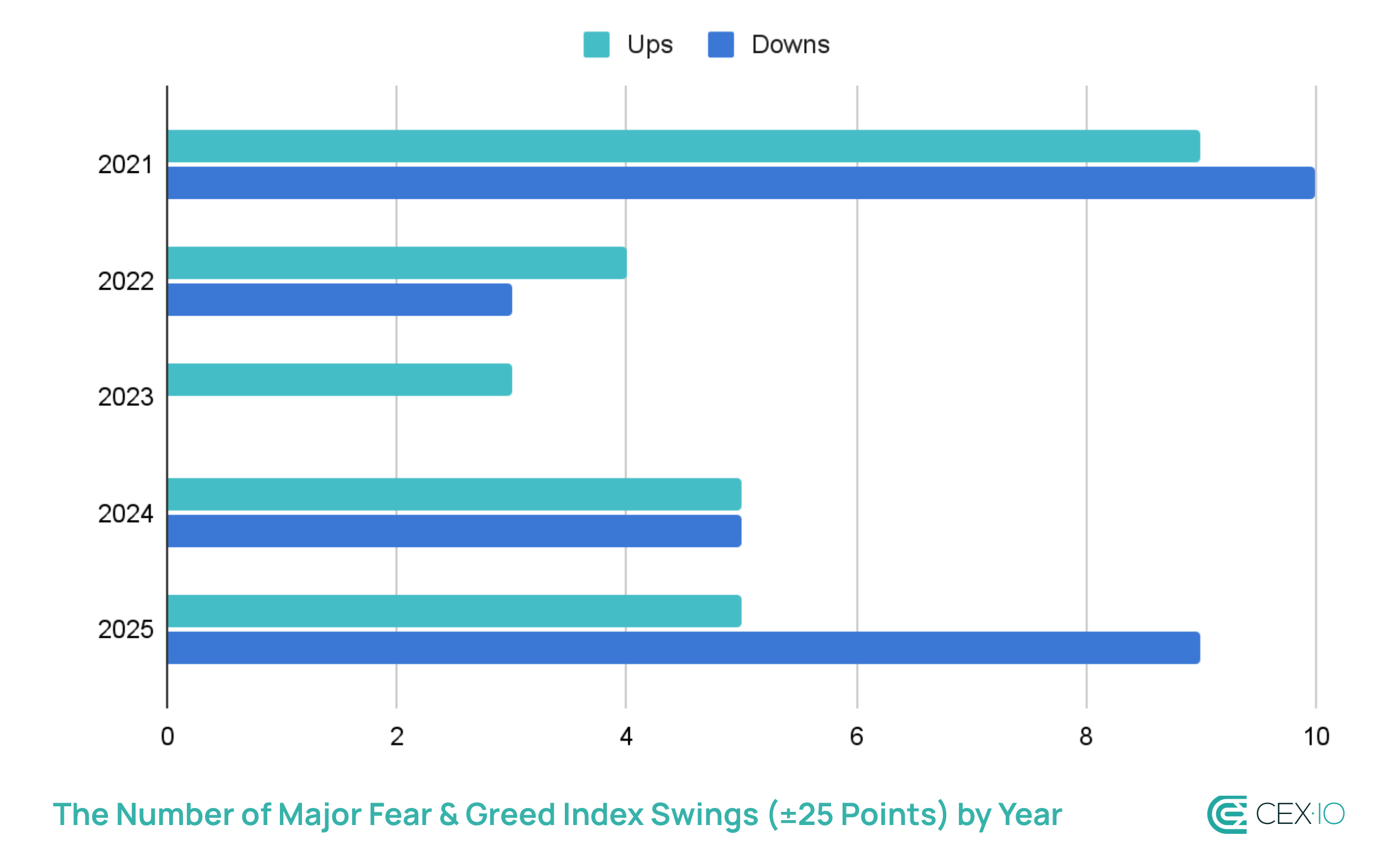

As such, 2025 has been the most turbulent emotional rollercoaster the market has experienced since 2021. In 2025 so far, there have been 14 events when the index moved by more than 25 points in a week, and in 9 instances, it was a rapid drop toward fear.

Crypto Markets Became More Fearful Than Stocks

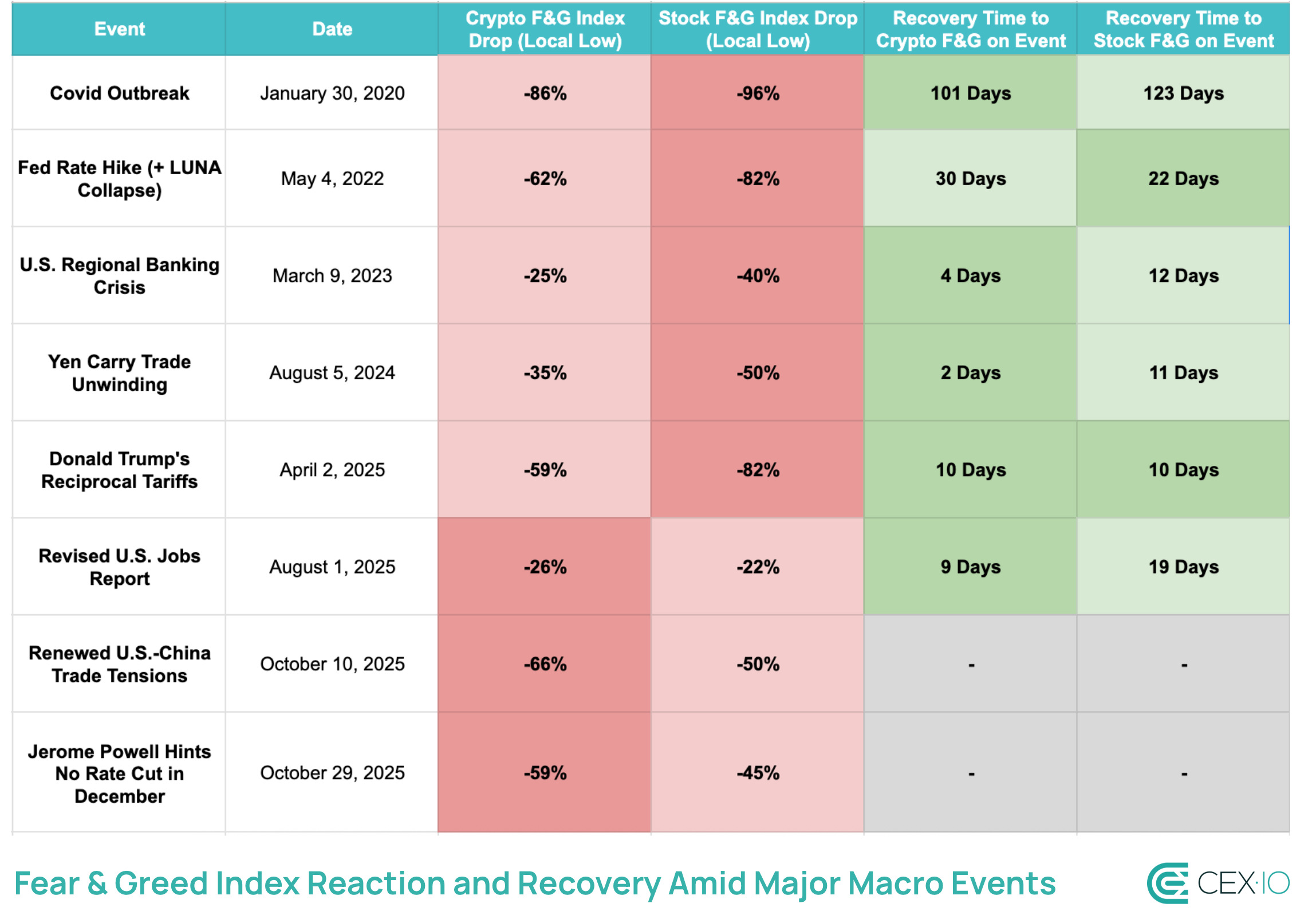

The sustained fear backdrop helps explain why October stands out as one of the worst months of the year for crypto in terms of F&G Index fluctuations. Firstly, after Donald Trump announced a 100% tariff on China and U.S.-China trade tensions renewed, the Crypto Fear and Greed Index fell from 64 to as low as 22 — a 66% drop

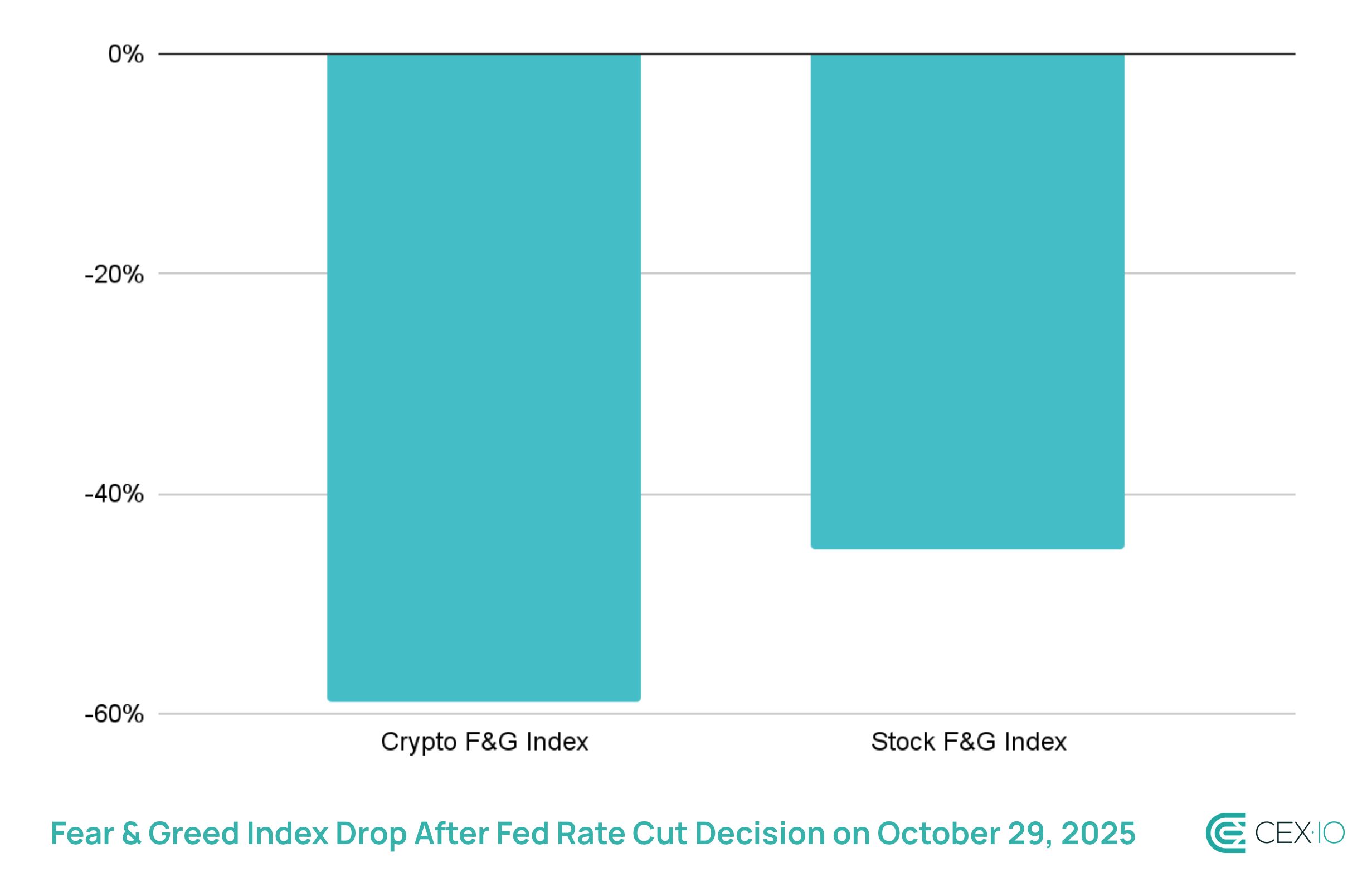

Shortly after that, another major drop occurred tied to Jerome Powell’s comments on October 29 that there might not be a December rate cut. This led to a 59% drop in Crypto F&G and 45% decrease in Stock F&G. The crypto market’s drop was also additionally fueled by an industry-local event such as a $128 million Balancer exploit on November 3.

The larger drops in the Stock F&G index are quite unusual, as when macro winds turn cold, stock investors typically panic harder and recover slower than crypto investors. For instance, after Trump announced tariffs on nearly all countries in April, the Stock F&G Index dropped by over 80% to a three-year low. In contrast, the Crypto F&G Index declined from 44 to 18 — a 59% decrease.

However, over the past few months, the F&G Index indicates that the crypto market has become more fearful than stocks. By its scale, the latest drops in the F&G Index are close to that seen during the LUNA collapse in mid-2022, which significantly intensified bearish momentum at the time.

Is This Rising Fear Justified?

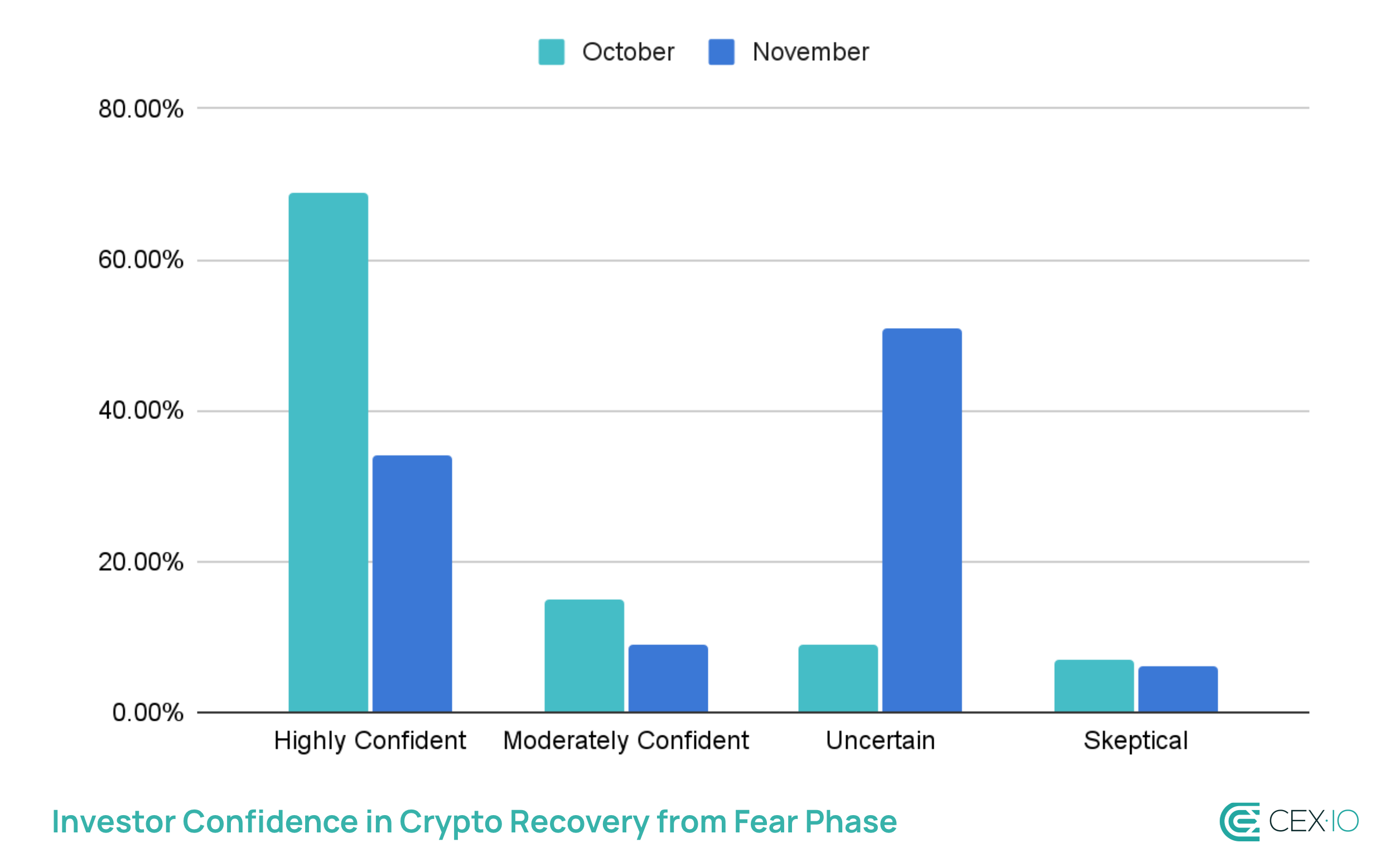

34% of investors are confident in a market rebound, down from 69% in October

To answer whether or not this fear is justified, CEX.IO conducted a two-stage survey among over 2,000 active users. The first round took place in October, and the second in November, both coinciding with periods when the Fear & Greed Index entered “extreme fear” territory. This approach allowed to track shifts in user confidence and expectations about the crypto market’s long-term performance.

Investor confidence in a strong market recovery fell sharply, with the share of highly confident respondents dropping from 69% in October to just 34% in November.& Moreover, 70% of respondents claim that the crypto market might have already reached the cycle peak, and a deeper correction could unfold.

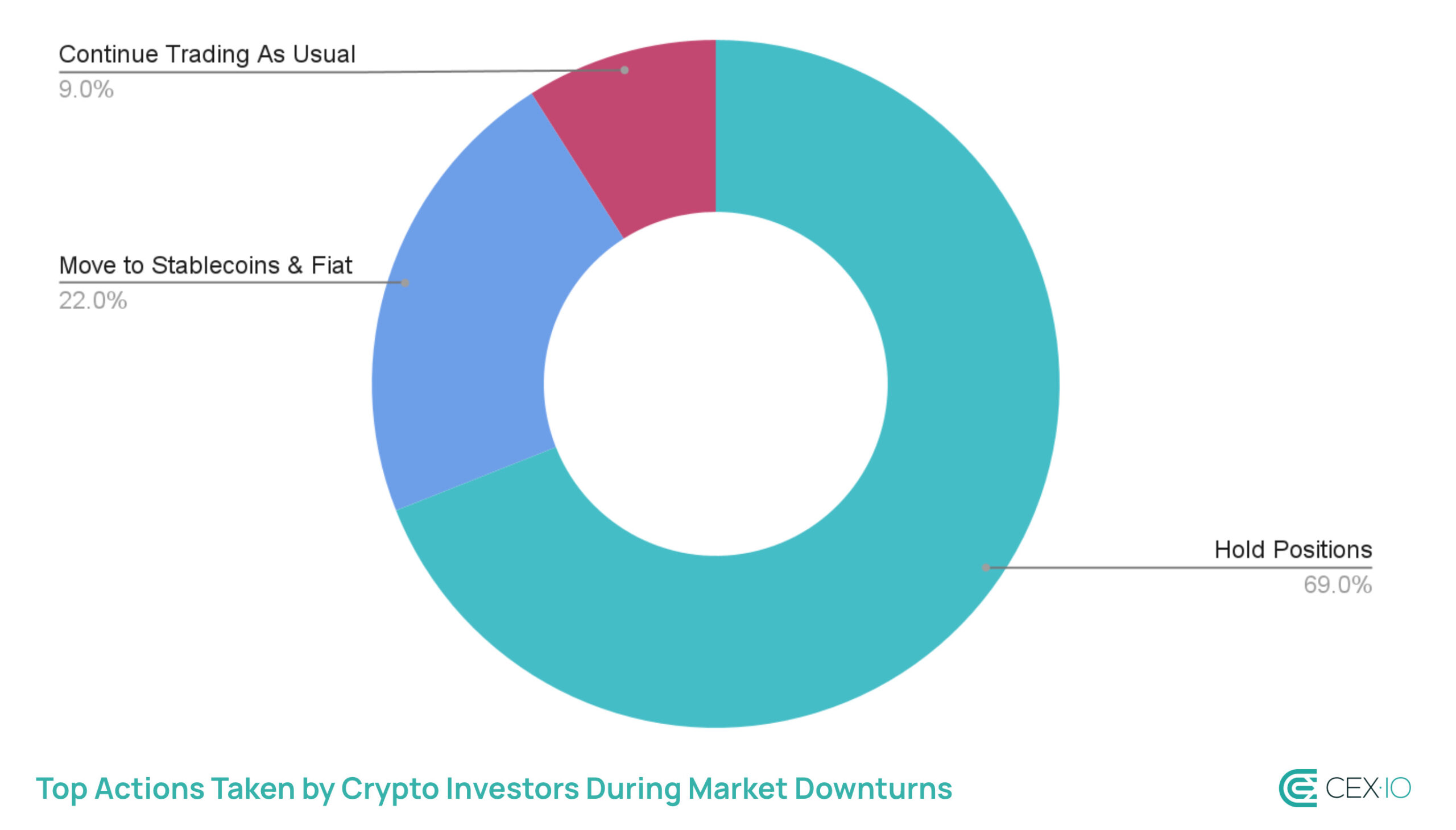

In both cases, around 70% of participants said they prefer to hold their positions during periods of market fear. However, a growing share indicated a shift toward stablecoins and fiat amid the current “extreme fear” phase, suggesting a rise in risk aversion.

Yet, the poll also revealed that Bitcoin remains the most popular destination for investors looking to navigate uncertainty. When asked where they plan to allocate during this fear cycle, 52% chose Bitcoin, while 15% favored Ethereum and other top altcoins.

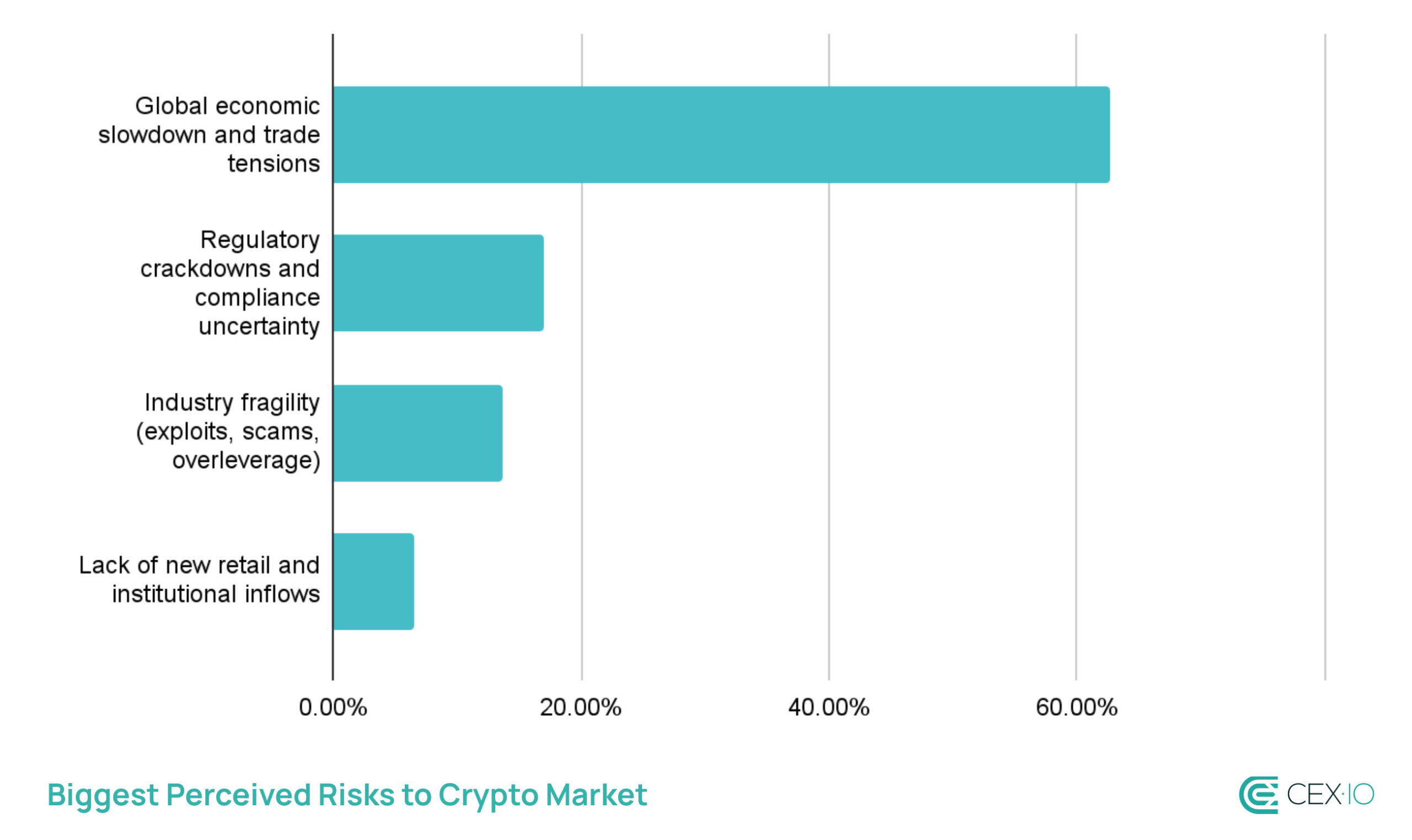

The biggest perceived threat comes from the global economic slowdown and trade tensions (63%), underscoring how macro pressures outweigh regulatory or internal industry risks.

Looking ahead, most respondents see macro improvement, or easing inflation and rates (59%), as the key catalysts for a potential revival, followed by improved liquidity and institutional flows.&

Overall, the survey shows a market that’s cautious but not broken — one where fear signals consolidation instead of capitulation.

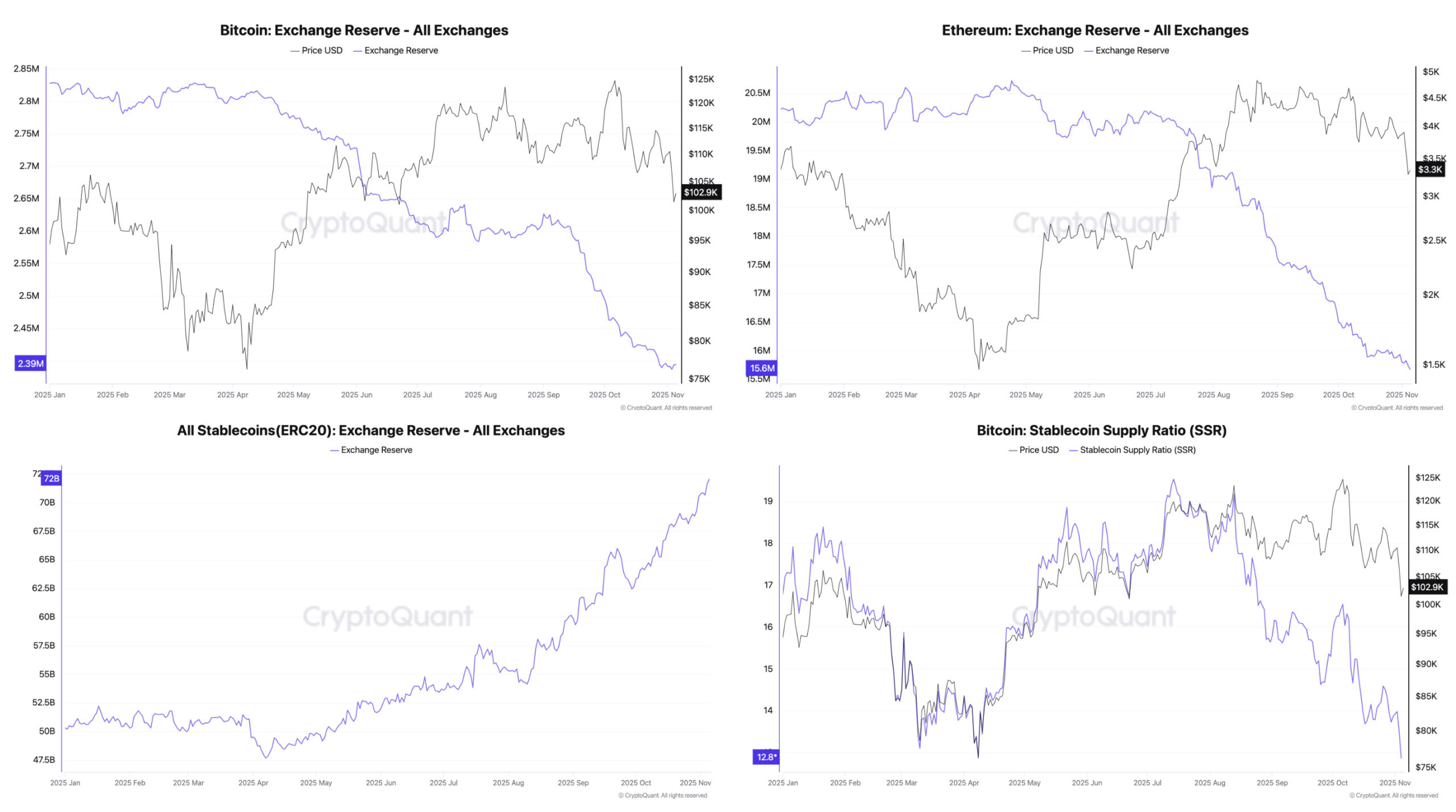

Exchange Reserves Suggest Fear May Be Overstated

Although the market reached “extreme fear” zones, exchange reserve dynamics hint that current levels of fear may exceed actual market stress. Historically, when panic truly sets in — as seen during the COVID crash in 2020 and the LUNA collapse in 2022 — BTC and ETH exchange reserves surged as traders rushed to offload holdings, while the Stablecoin Supply Ratio (SSR) plunged amid a mass flight to safety. Those moments reflected genuine systemic stress, when fear translated into measurable sell pressure and liquidity drains across exchanges.

This time, however, the picture looks very different. Despite U.S.-China trade tensions and disappointing macro signals, BTC and ETH exchange reserves kept declining — even faster than during earlier macro shocks this year. The SSR dropped by 22% in a month, but the market appears to be holding stablecoin liquidity on the sidelines — waiting for clearer macro signals before re-entering.

As such, this pattern reflects defensive positioning, where the market is increasingly getting ready to re-enter once macro uncertainty eases.

Chart: Exchange Reserves and SSR Dynamics in 2025. Source: CryptoQuant

Fear Is Becoming Rarer But Louder

In total, if we look at the share of the year the crypto market has spent in the fear zone, it appears the market became less accustomed to fear when it returns.&

Over the past few years, the crypto market has spent less time in “fear” territory. Even with heightened macro uncertainty in 2025, the combined “fear” and “extreme fear” periods account for about 31% of the year so far — well below past peaks and even some bullish phases like 2021.

This suggests the market may be gradually becoming less reactive to volatility. However, it also means that when sentiment does swing toward fear, it feels more intense. With fear phases now rarer, each occurrence tends to trigger sharper reactions and outsized narratives about market weakness.

Note: “Extreme Fear” refers to periods when the Fear & Greed Index falls between 0-24, while “Fear” indicates a range of 25-49.

Final Thoughts

The current surge in crypto fear appears more emotional than structural, yet it could become quite persistent, potentially leading to a deeper correction. Trade tensions, macroeconomic concerns, and a lack of new liquidity have clearly shaken confidence. However, unlike during the COVID crash or the LUNA collapse, it’s too early to say about systemic stress.& Confidence in a near-term rebound has weakened, yet few are capitulating outright, suggesting the market is consolidating rather than collapsing.

The web content provided by CEX.IO is for educational purposes only. The information and tools provided neither are, nor should be construed as, an offer, or a solicitation of an offer, or a recommendation, to buy, sell or hold any digital asset or to open a particular account or engage in any specific investment strategy. Digital asset markets are highly volatile and can lead to loss of funds.

The availability of the products, features, and services on the CEX.IO platform is subject to jurisdictional limitations. To understand what products and services are available in your region, please see our list of supported countries and territories. This page includes additional links to information about individual products, and their accessibility.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments